Raisin (SaveBetter) Review 2023: Legit Way to Save Money

Once you’re ready to purchase an investment based on your financial goals and liquidity preferences, you will fund your account by connecting an existing checking or savings account through Yodlee (a third-party app), or manually inputting your routing and account number for your current banking setup.

SaveBetter (Raisin) Review: The Best Place to Go for High-Interest Savings?

SaveBetter pools high-interest savings accounts and CDs from financial institutions nationwide, giving customers access to high-yield accounts they otherwise wouldn’t know about. But is SaveBetter the best way to secure the best savings rates? I answer that question and more in this SaveBetter review.

Jeff Rose, CFP® Jeff Rose, CFP® is a Certified Financial Planner™, founder of Good Financial Cents, and author of the personal finance. Read More

Colin Graves Editor Colin Graves is a personal finance writer and editor with a client list that includes some of the most prominent. Read More

Advertising Disclosure GoodFinancialCents® has an advertising relationship with the companies included on this page. All of our content is based on objective analysis, and the opinions are our own. For more information, please check out our full disclaimer and complete list of partners.

GoodFinancialCents® partners with outside experts to ensure we are providing accurate financial content.

These reviewers are industry leaders and professional writers who regularly contribute to reputable publications such as the Wall Street Journal and The New York Times.

Our expert reviewers review our articles and recommend changes to ensure we are upholding our high standards for accuracy and professionalism.

Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances, retirement planning and investments.

GoodFinancialCents® partners with outside experts to ensure we are providing accurate financial content.

These reviewers are industry leaders and professional writers who regularly contribute to reputable publications such as the Wall Street Journal and The New York Times.

Our expert reviewers review our articles and recommend changes to ensure we are upholding our high standards for accuracy and professionalism.

Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances, retirement planning and investments.

NOTE: In June 2023, Savebetter by Raisin rebranded to simply Raisin for better brand awareness

If this past year has taught us anything, it’s that investments that seem too good to be true almost always are. Many investors were burned by ‘can’t miss’ tech stocks and could only watch as the value of digital assets, like cryptocurrencies and NFTs, evaporated in minutes and couldn’t sustain the promised high returns.

In a highly volatile market, deciding how to invest your money is as challenging as ever, which is why rising interest rates have led many investors toward the safety of savings accounts and Certificates of Deposit (CDs).

This is where SaveBetter comes in.

SaveBetter pools high-interest savings accounts and CDs from financial institutions nationwide, giving customers access to high-yield accounts they otherwise wouldn’t know about.

But is SaveBetter (Raisin) the best way to secure the best savings rates? I’ll answer that question and more in this review.

Table of Contents

- What Is SaveBetter (Raisin)?

- 5.26%

- varies

- Key Features

- SaveBetter (Raisin) Products

- Is SaveBetter (Raisin) Legit?

- How to Get Started With SaveBetter (Raisin)

- SaveBetter (Raisin) Alternatives

- 5.26%

- varies

- SaveBetter Review: Final Thoughts

- SaveBetter (Raisin) FAQs

What Is SaveBetter (Raisin)?

SaveBetter (Raisin) is a financial technology company founded in late 2020 as a subsidiary of Deposit Solutions, now Raisin DS. Raisin works with over 400 banks in more than 30 countries worldwide.

What makes SaveBetter unique is that it’s a digital platform, not a traditional bank. SaveBetter claims to provide a digital “storefront” for banks and credit unions looking to promote deposit products to a larger audience.

Because the SaveBetter platform promotes products from lesser-known financial institutions, investors can take advantage of offers they may not have had access to otherwise.

Customers can choose between savings products from FDIC-protected banks and NCUA-insured credit unions that offer superior interest rates.

OUR PARTNER – Top Savings Accounts

5.26%

varies

Min. Initial Deposit

Key Features

| Account types | Savings accounts, Money market accounts, CD accounts, No-penalty CDs |

| Fees | None |

| Deposit Insurance | Yes |

| Customer Service Options | Email, phone |

| Customer Service Phone Number | 844-994-EARN (3276) |

| Web/Desktop Access | Yes |

| Mobile App Availability | No |

SaveBetter (Raisin) Products

With SaveBetter (Raisin), you can easily locate savings products from several financial institutions to ensure you’re earning the best possible yield.

You can also access your savings accounts and investments under one dashboard, For example, you could have a two-year fixed-term CD for your wedding savings and a high-yield savings account for your emergency fund, and view them both on the same dashboard.

High-Yield Savings Account. A traditional savings account with no limits on deposits and withdrawals. Allows you to earn a higher interest rate while having constant access to funds when you need it.

Money Market Deposit Account (MMDA). A money market account is a type of savings account at a bank or credit union that lets you earn interest on your money and make withdrawals.

No Penalty CD. Lock in an attractive rate for a set period with the ability to make a complete withdrawal at any point after the first seven calendar days of funding your account without paying the penalty. CD yields are usually higher than savings accounts.

Fixed-Term CD. Your money is held for a fixed period with a competitive APY that allows a predictable and safe return on your money. Fixed-term CDs offer higher rates than savings accounts and no-penalty CDs, but your money is locked in for the duration of the term, i.e., 1 Year, 3 Years, or 5 Years.

Is SaveBetter (Raisin) Legit?

SaveBetter is a legit way to invest. Even though SaveBetter isn’t a bank, your deposits with them are protected up to $250,000 with FDIC protection for bank products and NCUA coverage for credit union products.

SaveBetter is also a SOC 2-certified platform, and they use other security protocols, including multi-factor authentication, encryption, and advanced internet protection from Cloudflare.

While there aren’t as many SaveBetter Reviews online as you would find with more established banks, it’s likely that the service just hasn’t been around for long enough.

How to Get Started With SaveBetter (Raisin)

Here’s how you can get started with SaveBetter:

Step 1: Create your account.

Set up an account with your unique username and password in 3-5 minutes. It will ask you for the same information required when signing up for any kind of financial product.

Step 2: Review the different investment options.

Once your account has been activated, it’s time to review the various investment offers on the main page. You can choose between high-yield savings accounts, fixed-term CDs, and no-penalty CDs. You’ll notice a wide range of products from different financial institutions, so you can shop around until you find the most attractive offer for your situation. You can also explore these options before creating your account.

Step 3: Apply for offers.

You can apply for any FDIC-insured product listed on the platform. SaveBetter also lets you mix and match when it comes to the different institutions and offerings available. For example, you can invest in a high-yield saving account with Third Coast Bank and a fixed-term CD offered through Ponce Bank.

Step 4: Fund your account.

Once you’re ready to purchase an investment based on your financial goals and liquidity preferences, you will fund your account by connecting an existing checking or savings account through Yodlee (a third-party app), or manually inputting your routing and account number for your current banking setup.

From there, it takes about three business days for the transfer to go through. You’ll start accumulating interest on your money when the transfer hits your SaveBetter account.

Step 5: Manage your different investing accounts under one dashboard.

With SaveBetter, you can manage all of your accounts under a single dashboard. For added simplicity, you’ll only get one tax document from SaveBetter, even if you invest with multiple financial institutions.

SaveBetter (Raisin) Alternatives

As an online marketplace dedicated to savings products, SaveBetter is unique and has no direct competitor. That said, other online banks are offering attractive rates on high-interest savings accounts and CDs. Here are a couple of SaveBetter alternatives worth considering.

Ally Bank

Ally is an online-only bank that also offers high-yield savings accounts and CDs. With a 4.25% APY at the time of this writing, their savings account is slightly lower than what you can find with SaveBetter (Raisin). Still, it offers numerous features you won’t find elsewhere, like recurring transfers and savings buckets.

You also don’t have to worry about a minimum balance or maintenance fees with an Ally Bank savings account. However, if you’re looking for the highest return for your money, SaveBetter (Raisin) rates are higher.

SoFi

SoFi is an online personal finance company and a bank that allows you to complete your financial transactions in one place. You can have a checking account, savings account, credit card, credit score tracking services, and various other financial products under one umbrella.

SoFi is currently offering a savings account with a 4.50% APY. You can do all your banking in one place, and you’re guaranteed to earn interest on your money. With over four million users, it’s clear SoFi has become a one-stop shop for personal finance for many folks.

OUR PARTNER – Top Savings Accounts

Raisin (SaveBetter) Review 2023: Legit Way to Save Money

If you enjoy banking online and want access to high, unadvertised interest rates, check out Raisin, formerly SaveBetter, and its partner banks.

Grant Sabatier

At no extra cost to you, some or all of the products featured below are from partners who may compensate us for your click. It’s how we make money. This does not influence our recommendations or editorial integrity, but it does help us keep the site running.

Raisin (formerly SaveBetter)

Raisin, formerly SaveBetter, is still relatively new, so it’s working out some kinks, but it promises to be a great way to make your money grow. If you don’t mind banking online and want to take advantage of high, unadvertised interest rates, consider Raisin and its partner banks for your savings needs.

- No fees for the platform

- Higher, unadvertised APYs

- Only requires a $1 minimum deposit

- Access to high APYs from multiple banks in one account

- Customer service hours are limited

- No option for checking

You’ll want a high-interest rate if you want to make your money grow fast. However, shopping for the best rate and understanding the different terms takes some time and effort.

Raisin, formerly known as SaveBetter, promises to make it easier by partnering with small banks and credit unions that offer higher-than-average interest rates on savings accounts, money market deposit accounts, and CDs.

Here’s everything you need to know about Raisin and how it works.

In This Article

What Is Raisin?

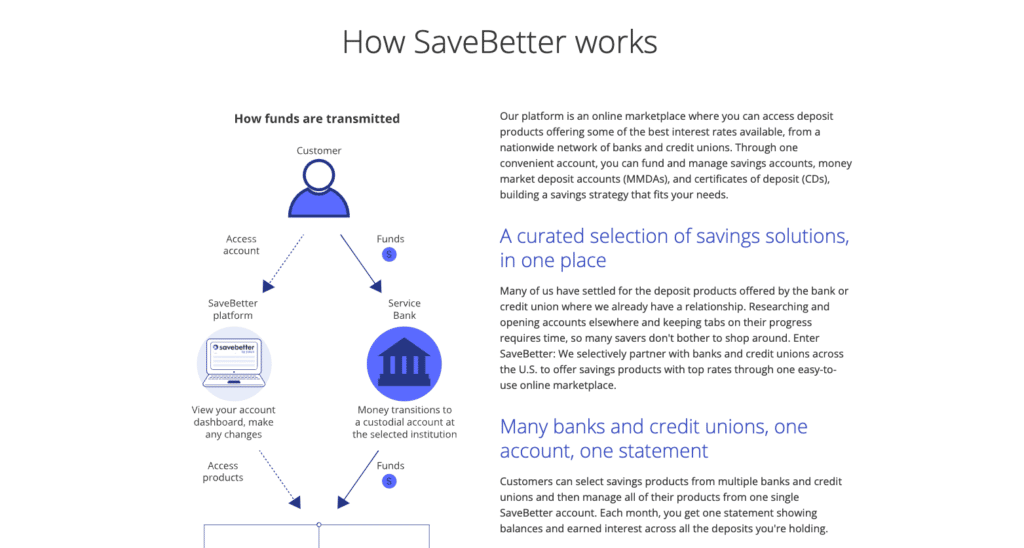

Raisin is a savings platform; it isn’t a bank. Instead, they partner with 10+ banks and credit unions to get members the highest APYs on their deposits. If you use Raisin, you use the platform to deposit your funds, but Raisin never touches your money. Instead, they use their insured service bank, Central Bank of Kansas City, to transfer the funds.

Raisin’s parent company is Raisin GmbH, which was founded in 1973 and has been operating in Europe with 400+ bank partnerships since 2012. They are new to the U.S. but have a long history behind them.

Think of Raisin as a marketplace. You sign up for one account and can compare savings products from multiple banks, many of which offer higher APYs than they advertise to the general public.

You won’t find large, national banks on the Raisin platform. Instead, you’ll work with small to mid-sized community banks that most people don’t know about when searching for a high-yield savings account.

Is Raisin Legit?

Raisin is new, but it is legit. They work with FDIC or NCUA-insured banks and credit unions, protecting your privacy with several bank-level security measures.

Trustpilot has only a limited number of reviews with the company being new, though there are many 5-star reviews, boasting the ease of use of the platform to find the best rates for savings.

How Raisin Works

View Rates with Partner Banks

When you join Raisin, you can view CDs, savings, and money market accounts at partner banks. Unfortunately, they don’t offer access to checking accounts.

All partner banks and credit unions are FDIC or NCUA insured, and each individual gets the insurance of the partner bank or credit union, as it’s considered pass-through coverage.

When you choose a bank account through Raisin, you don’t have an account number and can’t withdraw your funds directly from the partner bank. However, all deposits and withdrawals go through the Raisin platform, so it’s completely online and may take a few days.

Open Multiple Accounts in One Place

If you find an offer on Raisin, you can sign up for it through the dashboard. You never have to go to or contact the chosen bank.

You don’t have to put all your funds in one bank. Instead, you can split your funds among as many accounts as you want.

Here’s the unique thing about Raisin.

You don’t open an account in your name when you open an account at a partner bank. Instead, you transfer funds to a custodial account at the partner bank held by Lewis and Clark Bank. The custodial account pools the funds of all Raisin clients in the account.

Who Raisin Is For

Requirements to use Raisin:

- Be at least 18 years old

- Be a U.S. resident

- Have a valid social security number

Anyone can benefit from the Raisin platform as they promote higher APYs than traditional banks offer for savings, CDs, and money market accounts.

One catch, however, is you must be comfortable banking online, as all transactions go through the Raisin online platform. You must also be okay with handling your banking transactions through a third party, not directly through the bank or credit union.

Raisin Features

Understanding the Raisin features can help determine if it’s right for you.

Higher Interest Rates

One of the key features of Raisin is its higher interest rates. You might think the rates wouldn’t be high because the partner banks are small, community banks and credit unions.

However, they offer higher rates because it saves money on advertising.

If you’ve noticed the bonuses many banks offer, it makes sense. Banks spend a lot of money advertising accounts. Most would rather pay money to customers than pay for advertising.

Using the Raisin platform, they can easily advertise and reward customers who choose them by paying higher interest rates. In addition, since the APYs often beat regular banks that you can find yourself, you’ll make more money. The accounts are insured, so you don’t have to worry about losing money.

Raisin (formerly SaveBetter)

Highest APY Right Now: 5.15%

Raisin, formerly SaveBetter, is a secure and easy-to-use platform where you can fund and manage savings accounts from a network of federally insured banks and credit unions, all through one convenient account. What’s that ultimately mean for you? Higher rates on your entire savings.

Start Earning Now

Deposit Account Options

You have the option to open an individual or joint account at a partner bank in any of the following account types:

- High-Yield Savings and Money Market Accounts: With $1, you can open a savings or money market account through Raisin. Like most savings accounts, you get up to six withdrawals but can only access your funds online. The nice thing is there aren’t any maturity dates that lock your money up for the long term or penalties for withdrawing funds when you need them.

- High-Yield CDs: If you can tie your funds up for a while and like fixed income, the high-yield CDs offered can be a good choice. Most banks have 9 to 24 months CD terms, with some longer terms. You only need a minimum deposit of $1; the rates are higher than average. With such a low minimum deposit requirement, you can split your funds between CDs, locking up the funds you don’t need for a while in a longer-term CD and keeping the funds you need sooner in a shorter CD.

- No-Penalty CDs: If you’re worried about needing access to your funds locked in a CD, consider the no-penalty CD. These CDs pay a higher APY than traditional savings accounts but lower than high-yield CDs. The terms range from 10 to 17 months but may go as long as 36 months. The difference is you can withdraw funds from the CD prematurely without paying penalties. The goal is to keep the money in your account, but if you need it, you won’t lose money to penalty fees.

Fees

Raisin doesn’t charge customers any fees. This means you keep all interest income earned, and there aren’t any bank maintenance fees. Raisin makes money from its partner banks because they pay the platform to advertise for them, bringing in new customers.

Bank Partners

Raisin’s list of banks can change frequently, but currently, this is the list of banks they partner with:

- Adda Bank

- Axion Bank

- Central Bank of Kansas City

- Cloudbank 24/7

- Continental Bank

- FVCbank

- Hanover Bank

- Idabel National Bank

- Lemmata Savings Bank

- Liberty Savings Bank

- Mission Valley Bank

- mph.bank

- Patriot Bank

- Ponce Bank

- Sallie Mae

- The State Exchange Bank

- Western Alliance Bank

- Wex Bank

Safety and Security

It’s understandable to be nervous about using a technology company to deposit funds, but Raisin takes many precautions, including only offering accounts through FDIC-insured banks and NCUA-insured credit unions. They also use several security protocols banks use, such as multi-factor authentication and encryption.

Getting Started

If you like the thought of saving your money at several banks but with one platform, it’s easy to start. The platform can provide you a way to get the highest yields on your savings, seamlessly changing banks with a click of a button and not doing any of the legwork yourself.

Here’s how to start.

Create an Account

Opening a Raisin account takes only a few seconds. First, you provide your personal identifying information and create a password. Then, when you choose banks to deposit your funds, you must prove your identity with a government-issued ID and Social Security number, like any other bank account.

Evaluate Banking Products

Once you’ve signed up, you can compare the bank products available at partner banks. However, the offers you see are exclusive to Raisin customers, so you won’t find these deals when searching yourself.

Each bank offers different products, but overall, you’ll find:

- High-yield savings accounts

- Money Market deposit accounts

- Term CDs

- No-penalty CDs

You can view the offers at each bank by clicking on the account type. This will provide you with information about the product, including:

- Minimum deposit requirement

- APY

- Account Terms, including withdrawal limits

Please note that your funds are insured for up to $250,000. Because you’re opening a custodial account with Raisin, it doesn’t matter that your funds are in different banks. Each individual account gets maximum insurance coverage of $250,000.

Start Funding

To deposit funds, you must link an external account. For example, most people link a checking or savings account. You can add the account manually by providing your routing and account number or use the third-party app Yodlee to do it for you.

It can take a few days for your deposit to clear, and you don’t start earning interest until then.

Manage Accounts

You handle all accounts through the Raisin dashboard. This includes viewing your balances and YTD APY or depositing/withdrawing funds. Be sure you know the terms of each account, including how and when you can withdraw funds.

For example, if you open a term CD, you must leave the funds untouched for the entire term.

However, some may offer a provision to withdraw funds sooner, but you may pay a penalty, such as three months of interest.

Other accounts, such as HYSAs, typically allow up to six monthly withdrawals, but read the fine print to be sure.

Taxes

Like the FDIC insurance, your savings account through Raisin is one account for tax purposes. This means you receive a single 1099-INT, which can be tremendously time-saving when you have money in multiple accounts.

Again, this is because you have a single custodial account, but the funds are distributed throughout several banks within the account.

Raisin (formerly SaveBetter)

Highest APY Right Now: 5.15%

Raisin, formerly SaveBetter, is a secure and easy-to-use platform where you can fund and manage savings accounts from a network of federally insured banks and credit unions, all through one convenient account. What’s that ultimately mean for you? Higher rates on your entire savings.

Start Earning Now

Customer Support

To reach Found customer support, email them at [email protected].

Customer Reviews

Raisin currently has a 2.2 out of 5-star rating on Trustpilot with only 105 customer reviews. Here are what some customers of Raisin have to say:

5-Star Customer Review:

Raisin is great if you understand the concept. First, it’s not a bank. All these negative reviews call it a bank. Do your research FIRST, and understand where you are putting your money. VERY high rates, and a bare-bones, simple interface. I’ve had zero problems while earning top rates. Statement every month showing the banks you are invested in and interested earned. Thanks, Raisin ! Stephen Stamper Trustpilot

4-Star Customer Review:

Easy to manage, a lot of choice, good level of security, fantastic platform for high yield accounts. Willy.Nigel Trustpilot

2-Star Customer Review:

This platform might be ok for someone who doesn’t do any level of sophisticated banking moving funds between multiple financial institutions. Can’t have more than one linked accounts or funds that transfer via recurring transfers from an external account via checks. Upon deep investigation their platform proved far too limiting for my needs. Keith Trustpilot

Pros and Cons

It’s essential to determine the pros and cons of any financial product. So here’s what you should know about Raisin.

Pros

- May earn higher, unadvertised APYs

- No fees for the platform

- Access to high APYs from multiple banks

- Only requires a $1 minimum deposit

- Account management and tax reporting in one dashboard

Cons

- Less recognizable banks

- No option for checking or online bill pay

- Customer service hours are limited

Characteristics of a Good High-Yield Savings Account

Before choosing a high-yield savings account, you should consider the characteristics of a good HYSA. Of course, the temptation of higher interest rates can make you jump at the first offer you see, but here are some factors to consider.

- High-interest rates: This one is obvious, the higher the APY, the more money you make. However, read the fine print. Is it a promotional rate? This means it may only last a few months and then return to its standard rate. Other requirements to achieve higher rates, such as a minimum deposit amount, may also exist.

- No or low minimum opening balance: Determine how much the bank requires you to deposit to open an account. Some don’t have requirements, and others set higher minimums to provide higher rates.

- No or low minimum average daily balance: Some banks require a minimum average daily or monthly balance to get higher APYs. Read the fine print to see what happens if your balance falls below this amount.

- No fees: Bank fees decrease your earnings. Many banks don’t charge a monthly maintenance fee; others waive it if you maintain a specific balance. Look for banks that don’t charge fees.

- Frequent compounding: The more often interest compounds, the more money you’ll earn. Ideally, you want daily compounding but monthly is better than annual compounding.

The good news is Raisin accounts don’t have a minimum opening balance or ongoing requirements. You also don’t pay any fees, and Raisin banks pay unadvertised, higher interest rates than you find elsewhere.

Alternatives to Raisin

If you’re not ready to trust a technology company to handle your custodial bank account, there are alternatives to earn high-interest rates and handle the accounts yourself. However, there isn’t another platform like Raisin to compare directly. Instead, you would have to do the work yourself, opening accounts and determining how to earn the highest APY.

SoFi

SoFi is a personal finance company. They offer various products that help you manage your personal financial life, including checking and savings accounts and personal, student, and mortgage loans. They also offer investment products and credit score tracking and insights.

They currently offer up to 4% APY with no account fees and the ability to access your direct deposit up to two days early. In addition, they charge no overdraft fees and are FDIC insured.

Ally Bank

Ally is a bank that operates solely online. They offer checking, savings, money market accounts, high-yield CDs, credit cards, mortgages, auto and personal loans, and investment products.

They pay 5x the national rate in interest and are FDIC-insured.

They don’t require minimum balances or charge monthly maintenance fees. Ally Bank also offers features other banks don’t provide, such as savings buckets for specific goals and automatic transfers to increase your savings.

Frequently Asked Questions

Raisin, formerly SaveBetter, allows consumers access to higher interest rates than standard banks. Here are some common questions people ask about the process.

What Happened to SaveBetter?

SaveBetter, a subsidiary of Raisin GmbH, rebranded to the name Raisin in June of 2023. The platform still provides the same accounts and features as before, just under a new name.

Is Raisin A Bank?

Raisin isn’t a bank. Instead, they are a technology platform that provides offers from partner banks. They handle transferring the funds and providing all the information about your account, but they are not a bank.

How Much Can I Earn Using Raisin?

How much you earn varies based on how much you deposit and what offers you accept. Each bank or credit union offers different rates and has different requirements. The more you deposit and the higher the interest rate, the more you can earn.

Does Raisin Have a Minimum Balance Requirement?

Raisin’s minimum balance requirement is $1. This makes it easy for anyone to use high-yield savings, CDs, and money market deposit accounts.

The Bottom Line

Raisin is still relatively new, so it’s working out some kinks, but it promises to be a great way to make your money grow. If you don’t mind banking online and want to take advantage of high, unadvertised interest rates, consider Raisin and its partner banks for your savings needs.

Comments are closed here.

This website is an independent, advertising-supported comparison service. We want to help you make personal finance decisions with confidence by providing you with free interactive tools, helpful data points, and by publishing original and objective content.

We work hard to share thorough research and our honest experience with products and brands. Of course, personal finance is personal so one person’s experience may differ from someone else’s, and estimates based on past performance do not guarantee future results. As such, our advice may not apply directly to your individual situation. We are not financial advisors and we recommend you consult with a financial professional before making any serious financial decisions.

How We Make Money

We make money from affiliate relationships with companies that we personally believe in. This means that, at no additional cost to you, we may get paid when you click on a link.

This compensation may impact how and where products appear on this site (including, for example, the order in which they appear), but does not influence our editorial integrity. We do not sell specific rankings on any of our “best of” posts or take money in exchange for a positive review.

At the end of the day, our readers come first and your trust is very important to us. We will always share our sincere opinions, and we are selective when choosing which companies to partner with.

The revenue these partnerships generate gives us the opportunity to pay our great team of writers for their work, as well as continue to improve the website and its content.

Opinions expressed in our articles are solely those of the writer. The information regarding any product was independently collected and was not provided nor reviewed by the company or issuer. The rates, terms and fees presented are accurate at the time of publication, but these change often. We recommend verifying with the source to confirm the most up to date information.

]]>